Loop + AvaTax

OVERVIEW

Loop is configured to properly account for taxes in Shopify's native tax reporting. However, if you're managing tax reporting in AvaTax, the loop-discount applied to new exchange orders will prevent taxes from flowing properly into AvaTax since AvaTax calculates taxes based on the subtotal.

Taxes + Loop Discount (Default)

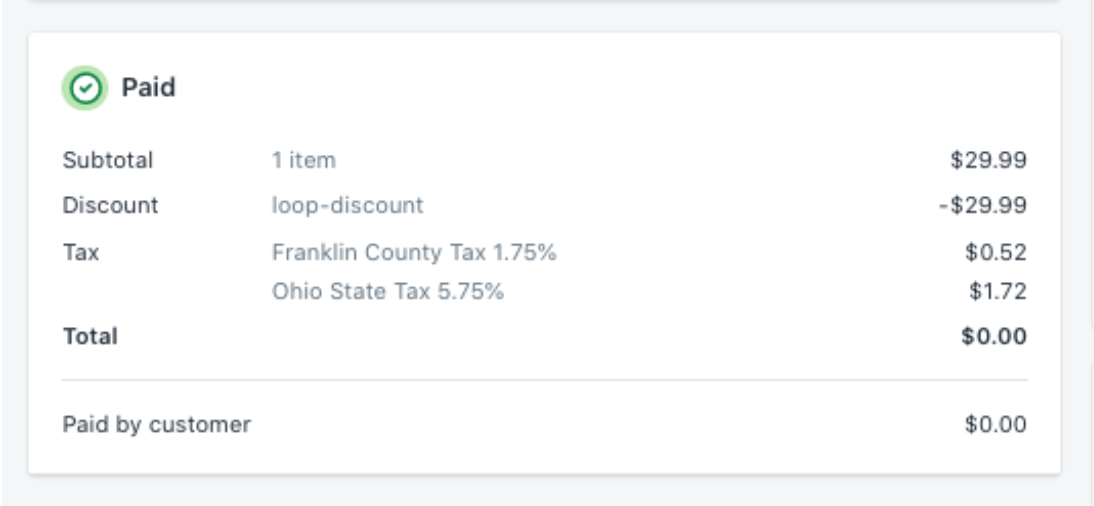

By default, processing a Loop exchange order will:

Mark the item on the original order as returned, subtracting the taxes associated with that product in both Shopify tax reporting + AvaTax

Create a new exchange order, with the value of the product discounted down to $0 with a loop-discount code (or discounted to the price of the upsell associated with the product for Shop Now upsell orders)

Add tax lines to the exchange order, leveraging your Shopify tax settings, that ensure Shopify's native tax reporting calculates the appropriate tax value.

Exchange order example, with loop-discount:

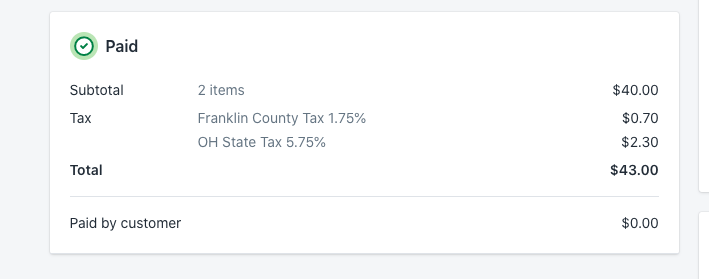

AvaTax Reporting + Loop's Solution

AvaTax's reporting does not leverage Shopify Tax lines. AvaTax will look at the subtotal, after discounts are applied, and use that value to set tax values within their system. To solve for this, Loop recommends disabling loop-discount and creating the exchange order at full value.

Exchange order example, loop-discount removed:

Please read Loop's Exchange Accounting Overview and The Loop Discount articles for more information to determine the best options for your business and reach out to support@loopreturns.com if you'd like to disable the Loop Discount or need any additional support.